| |

| What is Factoring? |

|

|

|

|

Factoring is the sale of accounts receivable. By Selling your invoices, you generate cash sooner than if you collected the money on your own. The factor company, in this case, BSL, would purchase your receivables, take title to the invoices and collect when the invoices are due. BSL assumes responsibility for all the costs, as well as the hard work and hassle that comes with customer debt collection |

.

| Suitable for Whom? |

|

|

|

Businesses who sell goods/services on credit. Factoring is an effective tools to turn accounts receivables into cash. A company who would like to convert future payment into immediate cash for working capital purpose.

|

.

Factoring Service Fees

-

Interest calculated on period of advances made.

-

Factoring Charge is calculated as a percentage of assigned invoices. This charge covers collection service and other related administration. BSL will provide on a regular basis, an Accounts Receivables Ageing and a Collection Report.

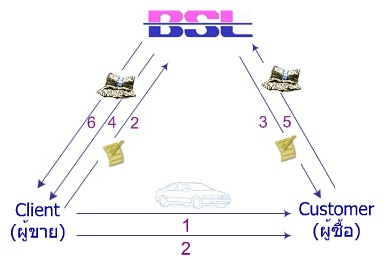

Factoring Process

-

Complete delivery of goods/services to his customer by Client.

-

Client submit required documents to BSL eg. Invoices, Delivery Order etc.

-

Client and BSL jointly notify the assignment of receivables to customer.

-

BSL make cash payment for the purchase of invoices based on pre-agreed ratio.

-

On maturity date of invoices, customer pay directly to BSL.

-

BSL pay client with excess amount, if any.

Factoring Benefits

-

Cash injection into working capital and improve financial liquidity.

-

You are not involved with any costs, hard work and hassles that come with debt collection.

-

You will be provided by BSL with a regular update/report on both the quality and the position of your accounts receivables transactions.

-

With improved cash position, you can leverage on increased purchasing power and take advantage of cash payment discounts from your suppliers.

|

|